You’re Not Late to Bitcoin

If you're someone who thinks they're always late or missed the boat, stop it.

Unless you’ve long muted the words “bitcoin” or “cryptocurrency” on social media and blocked that annoying guy from high school who won’t stop talking about memecoins (why is Kevin in Dubai again on a random Wednesday?), you probably saw that Bitcoin crossed the six-figure mark and is now worth over $100,000 US dollars. With it came raucous celebration from some of the worst people you know, as well as some smart people you might admire. I like to think I sit somewhere in the middle for most people who know me.

This is lowkey me.

It’s easy to see the euphoric bullposts, wallet screenshots, and other crypto content and think to yourself, “If only I’d listened. It’s too late now. These people are so lucky.” You’ve probably felt that way a number of times as it relates to crypto specifically over the past decade. Hell, the guy who bought two pizzas with Bitcoin in 2010 would be worth over a billion dollars today.

Wait, you think you’re late to Bitcoin? According to who? Thinking you are late to Bitcoin is a failure of ego. You are making unfair comparisons, largely with people that you’ve never met and have no understanding of their risk profile, or are simply being psy-opped into staying sidelined by the media, Peter Schiff, or something else outside of yourself. They’ve always sensationalized the criminals within our industry, so much so that you probably felt like it was a bit of a scam.

You can spend your days wishing you had just kept your Bitcoin instead of spending it on a fake ID or thinking it’s a scam. You can think you’re too late. You’re always too late. But it doesn’t make a whole lot of sense, and you can backtest this thinking fairly easily to see how silly it is. Is Michael Saylor late to Bitcoin? He’s buying billions of dollars worth of it at all-time highs. He’s not late, is he?

Moreover, it’s important to be honest with yourself. Even if you had been “early,” there’s little guarantee that you would have held long enough to realize those gains. There’s a reason the best-performing investors are literally dead people who can’t sell. You are your own worst enemy. The reason for this is simple, investing invites an emotional rollercoaster that the human mind is not designed to manage. Studies show that the pain of losing is twice as intense as the joy of winning, and the 70% drawdowns in the asset would likely have shaken you out long before you could be swimming alongside your yacht in Ibiza.

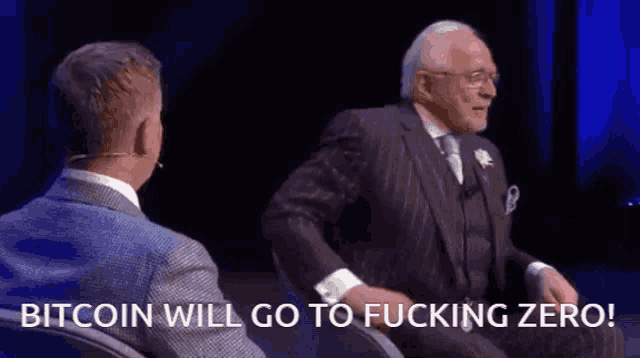

There have been plenty of times in which otherwise brilliant people have faded the greatest technological achievements of our generation. Thomas Watson, president of IBM, believed there would only be a world market for 6 computers. Robert Metcalfe believed the internet would supernova in 1996. I won’t bore you with more examples, but:

Take note that people have been calling for 0 for years, and they will continue to do so, even with a decade of being wrong thrust directly into their faces. The steadfast and irrational rejection of an inevitable outcome is always an asymmetric opportunity.

We are at the precipice of a total paradigm shift

In many ways, COVID accelerated the issues that drew me to Bitcoin many years ago. We’ve seen runaway inflation and the money printer’s been put in action in ways we’ve never dreamt possible. We’ve watched other currencies collapse. We’ve seen depression, loneliness, and greed run rampant throughout all industries. We’ve seen our fathers laid off and our mothers struggle to make ends meet.

Bitcoin has long been viewed as a risky asset class, and its volatility is daunting for many. Yet, consider the risks of inaction during the largest wealth transfer in history. Doing nothing carries its own perils. The devaluation of our currency undermines the value of your labor. Failing to grasp its long-term effects is a disservice to yourself.

In the early years, Bitcoin was designed as a subversive technology for cypherpunks to escape the throes of centralized, totalitarian governments and financial institutions. Programmable scarcity (only 21 million bitcoin, ever) was a deliberate rejection of unchecked monetary expansion by governments. It embodied a vision for all individuals to self-custody their assets, avoiding predatory banking practices and another 2008 crash. When you weigh the benefits of Bitcoin against the failures of centralized currency (especially during the last 4 years), it’s very difficult to remain sidelined. It certainly helps that the number goes in the right direction, but Bitcoin is increasingly becoming a consensus store of value akin to gold.

Bitcoin has again become a central topic in our elections and government discussions.

For the first time ever, Bitcoin has become a top 7 asset by market cap, surpassing Google, Amazon, and even silver. Bitcoin has also entered the global lexicon, and very few can claim they’ve never heard of it (even if they think it’s all a scam). How could you be late? Barely any institutions globally own the asset, with the world's largest asset manager, BlackRock, recently recommending a 1-2% allocation in institutional portfolios. If all institutions adopted this recommendation tomorrow, that would lead to over $2T of demand for Bitcoin.

How could you be late? Barely any countries own the asset. Companies do not have it on their balance sheet. The average person owns about .00244 BTC. Bitcoin is still banned in some countries. But this all looks like it will change very soon.

Bitcoin is digital gold

I remember the first time I ever saw a gold bar. It was magnificent and hilariously looked like cartoons always depicted it. I felt greed wash over me. It was the closest I will ever feel to Gollum.

Gold has gone on its own spectacular run this year, sitting near all-time highs as investors seek shelter from globally accelerating inflation. Boomers have long held this asset as the true inflation / apocalypse hedge. Its value as a rare metal is intrinsic and has been agreed upon for centuries upon centuries.

The inherent problem with valuing assets like gold lies in the uncertainty of supply. Gold’s appeal as a store of value depends on its perceived scarcity, yet we somehow keep finding more of it, undermining scarcity with each new discovery. Just this year, we found another $80 BILLION in Hunan Province, China. These discoveries aren’t anomalies; they’re regular reminders that the denominator–the total supply–keeps growing.

When the supply can expand unpredictably, the notion of scarcity becomes tenuous. How can we rely on something as a store of value when its true scarcity remains undefined and ever-changing?

Diamonds have also been completely obliterated by the rise of lab-grown gemstones, and the old guard seems to be shifting quite a bit. I can hardly imagine millennials or zoomers or any internet-native person buying gold bars at a pawn shop, at least not in the same size as boomers did. It’s much easier to fade gold here than Bitcoin.

The beauty of Bitcoin is in its programmable scarcity. There will never be more than 21 million of them. Governments can’t print more of it, Satoshi can’t change the code, and no one can counterfeit it. If you believe that assets are valuable because they are scarce, then Bitcoin is the most provably scarce asset in existence. Its launch was also as close to fair as possible, and people have had over a decade to acquire it.

You might be thinking, “But Bitcoin has no intrinsic value! Why is it worth anything? Can’t I just create another scarce coin with an even lower supply?” You can, but the beauty in scarce assets is consensus, in which we all agree that an asset is valuable based on some metric, and the free market ultimately determines what its price is. We might disagree on the value of an Argentinian peso, but it’s hard to argue gold’s consensus position as a store of value. We’ve already fought wars over it.

If you think you are late to Bitcoin, just compare it to gold, which has a market cap of $17T compared to Bitcoin’s $2.1T. That’s an 8x from here. Is that too late? Show me another $2T asset with that kind of growth potential. I’ll wait.

It’s taken over a decade, but we are approaching a broader consensus on Bitcoin’s value, and the broader the consensus is, the more reasonable it is to own the asset, which further cements its position in the world. This flywheel is extremely difficult to pull off and requires global coordination, but that’s the beautiful thing about decentralized systems. They permeate.

Bitcoin is the window into crypto

Shoku has a great tweet about how he missed investing in Uber, but it directly led him to one of his most memorable trades. He decided to buy puts on $TAXI, a public company with exposure to taxi medallions, believing that Uber’s success would crush the value of the public company. This turned into a 50x as the stock cratered and was a direct result of his bullishness on Uber.

Being “late” to an asset doesn’t always mean you can’t participate, and even if you think you are late to Bitcoin, you’re certainly early to crypto. Onchain users are dwarfed in comparison to the real world, and we’ve only just begun to scratch the surface of how crypto can revolutionize payments, gaming, and more. If you consider Bitcoin to be crypto’s “lightbulb moment,” then we are on the brink of a Cambrian explosion of use cases that one would do well to be exposed to.

Take stablecoins, for instance. If you look at crypto adoption in emerging markets, you’ll find that most users aren’t speculating or buying Bitcoin, but using US dollar-denominated stablecoins for payments and to escape runaway inflation in their own home currencies. It’s a lot safer to transact using USDC than the Nigerian Naira, and given that emerging markets have been ravaged by predatory fees and dollar restrictions, these users are already seeing serious benefits by switching to crypto-enabled financial rails.

Today, stablecoin supply has topped $161B, but this is quite minuscule compared to the $2.2T of dollars circulating in the world today. It doesn’t take a quant to understand the room for growth; you just need to look at where the puck is going.

There’s a prevailing thought in many new entrants into crypto that they missed the Bitcoin trade, and they need to compensate for this by going as far down the risk curve as possible. This pushes people to memecoins or, heaven forbid, trading XRP. There are plenty of opportunities in between that present venture-sized outcomes and actually have real-world ramifications. I wouldn’t work in crypto otherwise.

This time it’s different. I promise.

Look, I understand that every few years, it seems that there’s a new reason that people are shilling crypto to you, holding their hand out and trying to convince you to enter the market like an incel Pied Piper, and historically these pushes have been riddled with greed, rampant speculation, and the promise of what could be. You’ll just have to trust me that this time things are different because they are.

NFTs certainly put a bad taste in people’s mouths, largely because what was promised was a metaverse and a violent shift towards cyber reality that we were nowhere capable of pulling off in 2021. When you layer on FTX’s collapse soon after, it’s very obvious why crypto has the branding problem that it does. We’ve certainly done this to ourselves, and it doesn’t help when you have this guy telling you to choose rich.

These types of people, the grifting leeches that feast on your anxiety and hope, are a blight on our industry and a large part of why I started writing and bullposting on main. The opportunity ahead is too big to ignore, and it pains me when my loved ones stay sidelined because of misconceptions and deceit.

The vast majority of people suffer from a lack of conviction and dangerous risk aversion tendencies. They choose safe paths, and this risk aversion compounds negatively. This worked for prior generations for a long time, but the world is shifting and it seems this path has been somewhat squandered by government overreach and policy errors.

What’s worse, those who aren’t risk averse have turned to straight-up gambling, despite the mathematical impossibility of doing so. Parlays only make the casino rich. At a casino, there is no edge, and in fact, the deck is stacked against you.

Crypto at large has been maligned as a casino many times, and if you walk up to the edges of the industry, it’s certainly true. But it’s hardly all there is, and asymmetric, real opportunities abound, even with Bitcoin at $100,000. Just please don’t tell anyone that you’re too late. I’d hate for you to look silly.

People thought they were late here too.